What is a Rent Deposit for in Commercial Property Letting Transactions?

Taking a rent deposit as part of a commercial property letting transaction is common in the market place. A rent deposit is usually part of the negotiations between a commercial landlord and tenant when agreeing terms for a new lease.

A rent deposit in commercial property is a sum of money which is paid by the tenant to the landlord, which is held during the term of the lease, against non performance of the tenant’s lease obligations.

As experienced commercial property property agents, we will highlight the practical issues and commentary around taking a rent deposit as part of a commercial property letting.

Why would you take a Rent Deposit as a Commercial Landlord?

As a commercial property landlord a rent deposit would be requested as a form of security in a commercial property letting. The rent deposit is a financial sum that is held by the landlord in case the tenant does not pay rent, causes damage or other breaches of the lease obligations.

Having a rent deposit gives a landlord a buffer and protection should issues arise over the course of a commercial lease term which could lead to financial loss for the landlord.

There are a number of reasons why a landlord may seek a rent deposit, such as:

- The tenant is a new business with no trading history or a short period of trading.

- The financial standing of the tenant is limited or weak.

- The rent deposit is used as part of a number of measures to improve the security of the deal for the landlord (along with a guarantor, rent up front, etc).

- Holding a rent deposits is the market norm when negotiating lease terms (in stronger suburban London retail areas it is not uncommon for a landlord to hold a higher rent deposit than would be ‘normal’ in weaker out of town UK locations).

- The tenant may be undertaking works as part of a fit out, and the landlord insists on a rent deposit given the risk of tenant works.

- The property may be fitted out to a high standard and therefore the the rent deposit is used as protection against bad behavior.

- It may be used in negotiations, where a rent deposit is requested, but used as a bargaining point for the overall lease terms.

Holding a rent deposit as a commercial landlord is beneficial as it puts the landlord in a stronger position further down the line of a letting, should there be any financial issues with the tenant.

How much Rent Deposit should be held in a Commercial Property Transaction?

There is no standard rent deposit amount in a commercial property letting transaction. The rent deposit in a letting deal will depend on the negotiating position of the tenant and landlord.

Rent deposit amounts typically are discussed in terms of months rent, around 1 to 12 month rent deposit is the most common. However there is no set amount that is ‘normal’ and no minimum or maximum that can be taken.

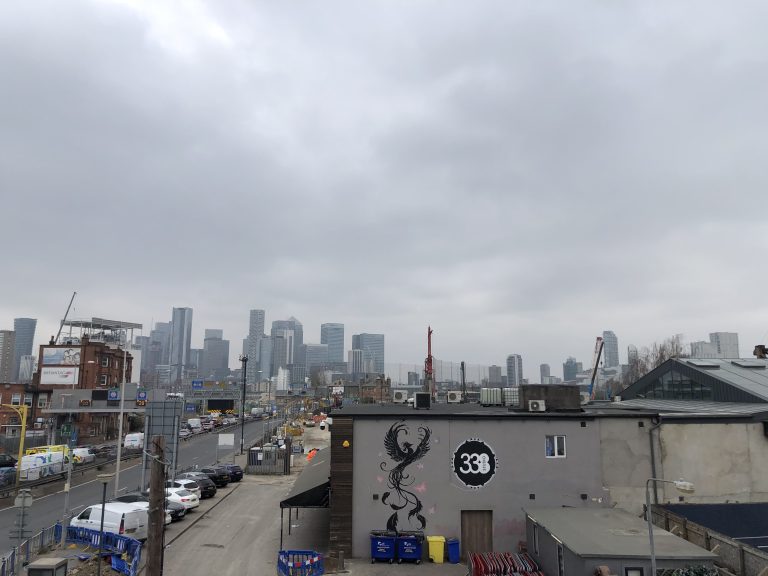

We have been involved in a variety of commercial letting transactions in the Greater London area, with anything from zero rent deposit to a 24 months rent deposit.

On some deals where there is a larger rent deposit amount (say 12 months rent deposit), then on occasions there may be a clawback included over time, so the tenant is paid back a proportion of the rent deposit on the basis of rent paid up to date, and performance of material lease covenants.

Are there alternatives to a Rent Deposit in a Commercial Letting?

There are of course alternatives to a commercial rent deposit, which a landlord and tenant may consider. The most common alternatives to a commercial rent deposit would be as follows:

- Director personal guarantor/s

- Parent company guarantors

- A significant amount of rent paid up front

Which one a landlord and tenant decide to choose, will depend on the detail of the deal. It may be that a combination of all are considered or one (or more) of the above, depending on the negotiation position of the respective parties.

Other points to consider when negotiating a Rent Deposit for a Commercial Property

VAT on Commercial Rent Deposits

VAT on rent deposits can cause issues depending on the status of the commercial tenant and landlord.

It is important to consider if VAT is elected on the rent deposit (whether it has to be or not) when negotiating the terms of the deal / rent deposit deed.

If the landlord has exercised the option to tax (charge VAT), the agreed deposit should then include the amount plus VAT. Main point being VAT should be considered when negotiating the rent deposit amount and advice sought if you are unsure.

VAT is a complex area and it is best getting professional advice from VAT expert on this point.

Tax on Commercial Rent Deposits

Some parties attempt to disguise rent deposits as premiums and therefore it is important to get appropriate legal advice when either a commercial landlord or tenant, and you are considering a rent deposit.

You do no want an unexpected SDLT as part of such a deal. Seek advice from your commercial property solicitor.

Cost of a Rent Deposit Deeds

The cost of implementing a rent deposit legally is important to consider. Your commercial property solicitor will charge for a rent deposit deed.

If the commercial property letting is say relatively low value, say as follows:

– £10,000 pa shop letting in Balham

– One month rent deposit is agreed (so £833.33)

The cost of a rent deposit deed via a commercial property solicitor is likely to be significantly eat up the one month rent deposit in the above example. Therefore it may be wiser to either consider a larger rent deposit or amendment to this deal.

The context of the letting deal should be considered as there is no point for the cost of the rent deposit implementation, to then negate the potential financial security of the rent deposit.

For smaller commercial property lettings a landlord may commonly demand a multiple number of months rent deposit, to ensure the transactions costs are proportionate.

We hope this helped you to consider practical points when considering the rent deposit when negotiating commercial lease terms.

Greater London Commercial can can help you negotiate terms when leasing a commercial property! Contact Greater London Commercial on 01708 973700 to discuss how we could assist you with our commercial estate agency services.