What’s My Commercial Property Worth?

Commercial property owners! Want to know what your commercial property is worth?

According to Statista the commercial real estate market in the UK is predicted to reach a value of $4.13tr by 2024. That’s a lot of potential commercial property value!

Whether you are considering selling, buying or just curious about your commercial premises value, this article looks at the key factors when analysing commercial property value.

Commercial property primarily acts as either an investment (therefore generating income) and or as business occupation by an owner occupier.

What Factors Determine a Commercial Property Worth?

The value of commercial property is determined by many factors. These factors ultimately relate to what a buyer is willing and able to pay, and what a seller is willing to sell at.

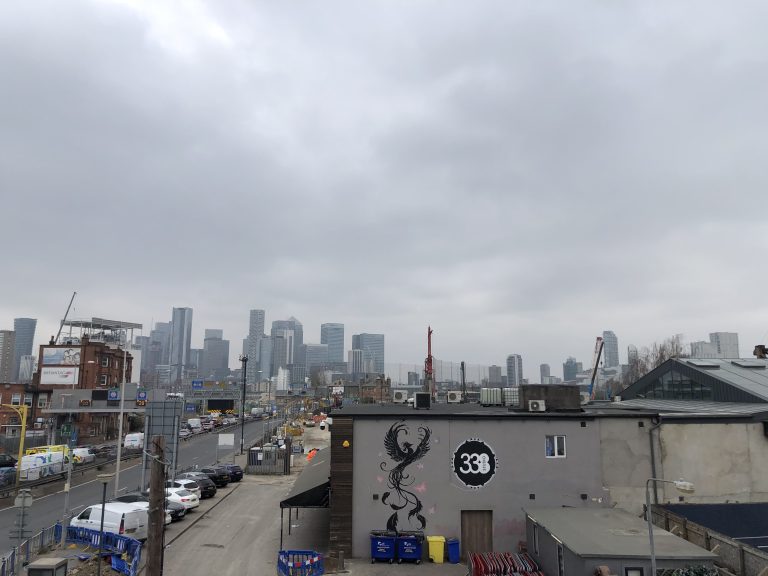

Location of the Commercial Property

Location, location, location! The location of a commercial property is arguably the most important factor. If a commercial property is located in a high value and in demand area that will trump many other factors on a macro level.

- A shop in a prime shopping area of Kensington, will command a higher value than a shop on a side street of the same shopping area.

- An office property in a trendy City Fringe area will command more in general than a secondary location in outer London.

Location also has an impact on a micro level as a corner positioned retail unit on Upper Street, Islington, may attract a higher value than a property within an inner parade on the same street. An industrial unit close to major transport infrastructure will likely command higher values compared to one not so close to transport links.

Whilst the location itself can’t change from an objective sense, locations do transform over time and can become more or less in demand and, or fashionable. For example, think about the demand for commercial space in many areas of London such as Hackney, Peckham, Lewisham, Brixton, Islington, etc which has changed significantly since the 1980’s through the 1990s and 2000s as tastes change, regeneration and supporting infrastructure improves.

Investment in housing, transport, supporting business and consumer tastes all contribute to changes in demand from tenants, buyers and investors. Following the money and infrastructure spending, may give clues to medium / longer term chances of value increases for commercial property.

Potential Income Generated from the Commercial Property

The potential for a commercial property to command a rent from a prospective commercial tenant, will impact the value of the property.

Put simply, the higher the potential commercial rent, the higher the selling price will likely be. The risk of that income flow and therefore yield will also matter, as the security of the income results in the price a buyer will pay.

The return an average investor commands from a prime central London commercial property investment would generally be lower than for an outer London shop Investment in the London Borough of Bromley for example.

A commercial property investor will demand a certain return (or yield) from a property asset, and that will determine what price a buyer is willing to pay. Generally investors will demand higher yields for riskier property assets, and lower yields for safer / less risky assets.

Type of Commercial Property

The type of commercial property will determinate the value, in terms of the specifics of the property class, age and specification and condition.

- Use (whether retail, office, industrial, etc)

- Modern / age of the commercial property

- Specification

- Condition

More highly specified commercial property tend to be higher valued, relative to other factors. A modern and well specified office in Shoreditch, would be generally be worth more than an older secondary office in the same location.

A commercial property in better condition, all things equal would tend to be worth more than a property in bad condition. A commercial building in better condition, means a buyer doesn’t have to spend more money putting the property in ‘good condition’ and therefore is likely to pay more when buying the property.

The use of the commercial property will determinate the value, especially if there is restriction on use or there is development potential for a higher value use (say an MOT garage in Wandsworth with future development potential for a mixed use development compared).

Size of the Commercial Property

Logically the larger the commercial building or land, the likelihood is that the value of the commercial property will be larger. However there are diminishing returns at a certain level, depending on the type of property, and with most commercial premises, as the size increases it means other occupational costs also increase.

For example, a department store (40,000-50,000 sq ft) in the West End compared to a double fronted shop of 1,500 sq ft in the West End. The value per sq ft would tend to be higher for the double fronted shop, although the overall value would be higher for the much larger premises.

Also some buildings which are very large will also come with corresponding holding costs when empty, which impact on the perception of value in the market.

Credit Conditions / Interest Rates

The ability for a buyer to obtain a commercial property mortgage or financing for a purchase of a commercial building will impact on the demand for commercial property.

The relationship broadly is that as credit conditions become looser (easier for borrowers) and interest rates decrease, this will increase the demand for commercial property and value.

If there are more owner occupiers, investors, developers and speculators able to borrow money in order to acquire commercial property, that drives up demand and prices.

Similarly if interest rates increase this tends to have a negative impact on demand and values as less potential buyers have the means to transact.

What’s low and high interest rates is of course relative. After an extended period of low interest rates since 2009 until very recently, most buyers consider interest above 5 – 6% as towards the higher range.

The Economy & Market Sentiment

The economic conditions and market sentiment impact on the demand for commercial space.

If the economy is relatively buoyant and growing then that results in demand for more office, retail, leisure and industrial space. That relationship has become more complex given the changing working, shopping and leisure habits, but in simplistic terms, an economy that is growing should create more demand for commercial space.

Positive GDP growth also impacts on market sentiment as buyers try to gauge where the market may be heading.

In our opinion this factor is more nuanced, as a growing the wider economy may not translate into more commercial demand for some property types. For example, although London’s economy has been very resilient since the covid pandemic and lockdown, demand for retail in some Central London locations (say, Fleet Street, Bloomsbury) has been lower, where as outer London areas (say, Crystal Palace, Upminster) has seen increased demand. Also changing trends globally has led to much more space for industrial / warehouse space, relative to retail and office space.

How do you Determine what a Commercial Property is Worth?

There isn’t a one size fits all way of determining the value of a commercial property, although several methods are commonly used:

Comparison Approach

The Comparison Approach is the most commonly used method to determine the value of a commercial property.

This relates to direct capital sales, investment sales, lettings evidence and a range comparable commercial transactions.

If an office property in Stratford has sold for £300 sq ft of the same size and standard (all other factors equal) next door, then logically that is a good evidence with the comparison approach to determine the prospective value.

In reality many commercial properties are not always perfectly and directly comparable. A shop property that sold in Barking in 2021, may be useful data for considering the value of a shop property in 2024, however the date of transaction is different, the size, condition, legalities, and circumstances of sale are distinct.

Therefore in these circumstances, there is a level of judgement that is made together with the comparable evidence, to consider what a commercial property may be worth. However the comparison method remains the most popular method widely used across the commercial real estate market.

Income Approach

The Income Approach is utilised for commercial investment property, which are income producing.

Using the income approach, the potential income of a commercial property is determined by it’s income divided by the capitalisation rate (yield).

The comparison method may be used to access the inputs that go into the income approach. The quality and accuracy of the inputs are important, otherwise the income approach could be misleading.

Comparables to determine the appropriate income for a 2000 sq ft office in Greenwich and capitalisation rate (yields), could be used. Say the rental rate based on the data indicates a £30 sq ft for this office space in Greenwich, and that an investor would pay a 6% yield. Therefore, in simple terms a transaction could be as follows:

- 2000 sq ft x £30 sq ft = £60,000 pa

- Yield = 6%

- Income Approach = £60,000/0.06 = £1,000,000

Cost Approach

The Costs Approach is accessing the construction costs of the building and the land, however this is a simplistic method as it doesn’t reflect the market appetite / potential income that could be generated.

Like all methods this approach, relies on the inputs. Costs of construction can be challenging to track and estimate accurately and requires professional assistance.

Profits Approach

The Profits Method can be used where there is a operating business within the commercial property, and is often suitable for hotels, cinemas, pubs. bars and leisure related property.

Effectively the profits method is looking at the incentive to trade from that location. As part of this process the financial accounts of the business will be accessed and this will be used to access the performance of the business. The reliability of the accounts are of course key, as the quality of the information will determine the reliability of the profits method.

Calculations related to the gross profit and net profit are then used to for the profit methods.

Check your Commercial Property Value?

It can be a minefield finding appropriate advice from commercial property experts given that such properties are distinct and many aspects must be considered.

If you are considering selling a commercial property, it is important to get a realistic marketing appraisal regarding the potential commercial property

So as a commercial property owner if you want to consider the potential value of your property, it’s best seeking advice from an experience commercial property professional

We can offer a free no obligation commercial property marketing appraisal (valuation)! Please get in touch today!